Chinese Electric Cars Compete With Gasoline-Powered Cars in Europe and Beyond

The Chinese government has been a major force behind this boom. It has used a mix of credit subsidies, procurement contracts and tax breaks to cultivate a slew of homegrown EV brands that have optimized new technologies to fit real-life consumer needs.

But the US executive branch has shown such hostility toward cheap Chinese EVs that companies like BYD are unlikely to seek entry into the American market anytime soon.

Cars Cost

For a number of reasons, electric cars tend to cost less than their gasoline-powered counterparts. The upfront price is lower, and the operating costs are considerably lower thanks to their zero-emissions nature and fuel savings from the switch to electricity. Achieving price parity is key to EV adoption. That’s true in developing markets with comparatively low household and business incomes, but also in advanced economies where the initial purchase price premium can be off-putting to consumers, especially among mass market segments.

In China, ferocious price competition among local carmakers has created a large range of affordable EV models. For example, the base model of BYD’s compact Seal U Comfort sells for about 21,769 euros ($23,370) in China and 41,990 euros ($45,078) in Europe, according to Rhodium Group estimates. In many cases, these EVs are cheaper to own than their best-selling small ICE vehicles.

Nevertheless, the high profitability of the Chinese electric vehicle sector makes it a target for trade action by EU officials, who worry that China’s battery electric vehicle (BEV) manufacturers are benefiting from unfair subsidies. In response, the European Union (EU) plans to impose tariffs of up to 38.1% on a wide range of imported Chinese BEVs, or around the same level as its current 10% car purchase tax.

The US, Canada and Mexico are major buyers of EVs, but they’re not currently purchasing many directly from China. In 2023, direct Chinese EV exports to the three countries that are parties to the USMCA totaled only $368 million.

Assuming the tariffs take effect, it’s likely that the majority of sales in these markets would continue to be dominated by Western carmakers, like Tesla, BMW and Mercedes, which are building plants in the region. But a higher duty could crimp European manufacturers’ profit margins, and that’s one reason why some of them are seeking to avoid the tariffs by setting up operations in the region.

For instance, BYD has a plant in Hungary and Chery has a joint venture with a company in Spain’s Catalonia region. The EU’s proposed tariff on EVs would raise the cost of a car sold in these regions by about 30%, which might be enough to offset the benefits of cheaper production costs for some of them.

Cars Energy efficiency

BYD and other Chinese EV makers have been racing to become global players. The growth of these companies, and of China’s EV industry in general, has shaken up the world of cars in ways many didn’t think possible just a few years ago.

In 2022, for example, China sold nearly six million EVs—more than the entire European Union combined. And that figure is likely to grow even more this year.

The reason is simple: cheap, efficient, and well-designed electric vehicles are incredibly popular with Chinese consumers.

Beijing has long supported EV development, leveraging subsidies and other incentives to promote the use of alternative-fuel cars. This policy isn’t just a means to meet the country’s climate goals, but also to build a competitive domestic auto industry.

For China, EVs offer a way to reduce pollution, save energy, and lower fuel costs. And Chinese manufacturers are now making EVs that can compete with traditional models on price and performance.

China’s low-priced EVs aren’t just gaining popularity at home, but in Europe and the United States as well. And they’re threatening to upset established automakers in the process.

The emergence of Chinese brands in the West is a source of concern for some lawmakers, who see them as a threat to American jobs and national security. For example, Congressman Mike Gallagher of Wisconsin has called for tariffs on Chinese EVs and other products, saying that the country uses “economic coercion and market manipulation” to dominate the world’s markets.

In Europe, Chinese EV exports have surged, and the European Union has launched an investigation into whether or not Beijing has been subsidizing companies in violation of international trade rules. If the EU imposes a trade penalty, it could put pressure on Chinese carmakers to produce more affordable cars for its market.

Despite the threat of tariffs, Western automakers are pursuing their own low-cost strategies to boost sales of electric vehicles in the United States and around the world. One such strategy is vertical integration, allowing companies to produce their own batteries as part of the manufacturing process. This can significantly cut costs and ensure the quality of a vehicle’s components.

Cars Range

China’s carmakers are also making a major push into Europe, which has been a good testing ground for them. European buyers are more open to Chinese EV brands, and their cheaper prices make them a strong competitor in the market.

But the biggest battleground will be the United States, which has so far been hostile toward cheap Chinese EVs. The administration’s hostility, coupled with the fact that American consumer tastes are different enough that it would be difficult for Chinese makers to produce cars tailored to US customers, has so far deterred them from trying.

In contrast, European governments are embracing EVs, and they have been providing subsidies to help them get off the ground. In addition to the European Union’s common set of standards for EVs, each member state has its own individual rules and incentives. For example, Germany has tax credits for EV purchases that are double and triple those available in the United States. And in the United Kingdom, consumers can purchase a new electric vehicle for less than the price of a conventional model.

Moreover, Europe and the United States account for around two-thirds of global EV sales and stock, so any shifts in these markets have a big impact on global trends. As the global transition to EVs continues, many traditional automakers in these regions will have to compete with Chinese companies in order to survive.

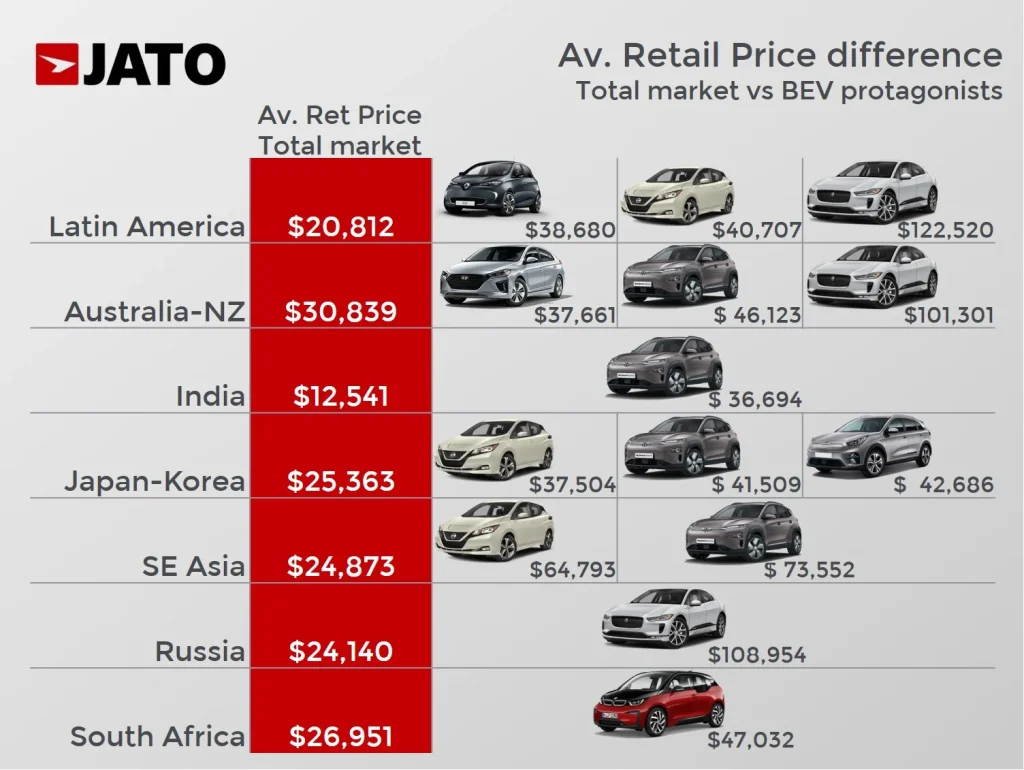

While Western manufacturers are working to produce more affordable EV models, it will take time for them to catch up. According to a report by JATO Dynamics, the cheapest EVs currently sold in Europe and the United States cost 92% and 146% more than their ICE counterparts, respectively.

By comparison, the cheapest EV in China costs only 8% more than the cheapest ICE car. China’s success is due in part to its genuinely impressive innovations; synergies with the country’s massive industrial capacity, including its shipbuilding sector; economies of scale; and, of course, massive national, provincial, and even local subsidies. All of these factors are helping to drive down the price of Chinese EVs, which will have a profound effect on global trends.

Read More articles about it: S&P 500, Nasdaq at record highs as lukewarm inflation fuels rate-cut bets-Markets

Cars Safety

Chinese EV brands are gaining ground outside China in the United States, Europe and beyond. While a handful of companies, such as BYD and Nio, have global ambitions, many are expanding at breakneck speeds to become low-cost players in the global auto market. Their rapid growth worries the U.S. car industry, which sees them as a threat to its traditional business model.

Unlike legacy automakers, which were transitioning to electric propulsion while attempting to maintain existing models, most Chinese EV makers were founded as battery tech specialists and optimized vehicles specifically for electric powertrains from the beginning. That, combined with massive scale and the ability to produce cars locally in huge quantities, gives them a cost advantage, which is why they’re able to offer much lower prices than their Western counterparts.

For the most part, Chinese EVs are powered by renewable energy sources, which help cut emissions and pollution. However, some Chinese manufacturers are experimenting with using coal-powered electricity to run some of their vehicles. That may raise safety concerns, but the overall picture is one of rapid progress as Chinese EV makers seek to reduce the environmental impact of their vehicles while remaining competitive with their competitors.

The emergence of cheaper Chinese EVs has alarmed some European politicians, who launched an investigation into whether they receive state subsidies that give them an unfair advantage in global markets. The probe could lead to the imposition of tariffs on Chinese EV exports, which would hurt companies like BYD that are rapidly growing their sales outside Europe and need the extra revenue from abroad to fuel future growth.

Amid the political wrangling, some companies are seeking a middle ground. For example, BYD, which counts Warren Buffet as an investor, is working with the government of Mexico to open a factory in the country that will produce cars for export to the United States. The company expects to begin production there next year.

Regardless of the outcome of the probes, one thing is clear: The rise of Chinese EV makers will challenge automakers around the world, including those in Europe, to make the transition to electric vehicles a reality. They’ll have to decide whether to work with those companies or to compete against them by making their own more affordable alternatives.